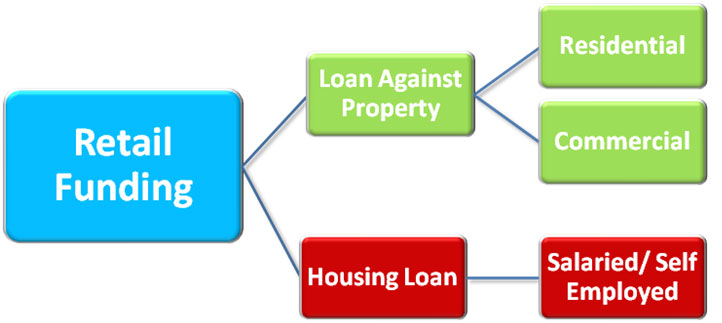

Retail Funding

- Loan against Property (LAP)/ Property Power Loan

- This is an EMI based loan and it also called Term Loan

- It may be a fresh loan, Top-up loan or take-over and enhancement loan.

- This Loan can be funded against the following properties:

- Residential Property

- Commercial Property

- Industrial Property

- Warehouses/ Godown/ Cold Storages Property

- Loan to Value (LTV)

- Residential property 60-70% of the Fair Market Value

- Commercial Property 50-60% of the fair Market Value

- Target market:

- Salaried (Corporate, non- corporate)

- Self Employed (Sole proprietor concern, Partnership firms, private limited companies, Educational Institutions and Hospitals)

- HNI with Huge rental Income from Corporate tenant

- Loan Tenure: minimum 5yrs and maximum 15years

- Borrower age: Minimum 23years

- Business Continuity: Minimum 3 years of continuous operation of business

- Minimum Income: Rs. 3 lacs of annual income

- Minimum Loan: Rs.50 lacs

- Maximum Loan: Rs 50 Crs and in case of LRD Rs.300 Crs

Loans Against Residential Income

080-41518170

080-41518170